- Agriculture (2006-2009)

- Agriculture : mutation (2005-2006) FR ES

- Agriculture: emblematic landscapes

- Agriculture: food-self sufficiency (2005-2007)

- Agriculture: production (2007-2008)

- Commerce extérieur (2001) FR

- Currencies

- Economic organisations (2009)

- Fishing (1995)

- GNP per capita (1995)

- Integrated energy strategy (2004-2007)

- La Chine dans la Caraïbe FR

- La pêche dans le bassin Caraïbe - 2019 FR

- Le bassin caribéen, théâtre affirmé d'une guerre d'influence sino-étasunienne ? FR

- Nouveau contexte pétrolier (2015) FR

- Nouvelles donnes régionales (2004-2006) FR

- Sugar and Oil (1999-2011)

- Tax havens (2007-2010)

- Tax havens (2008-2012)

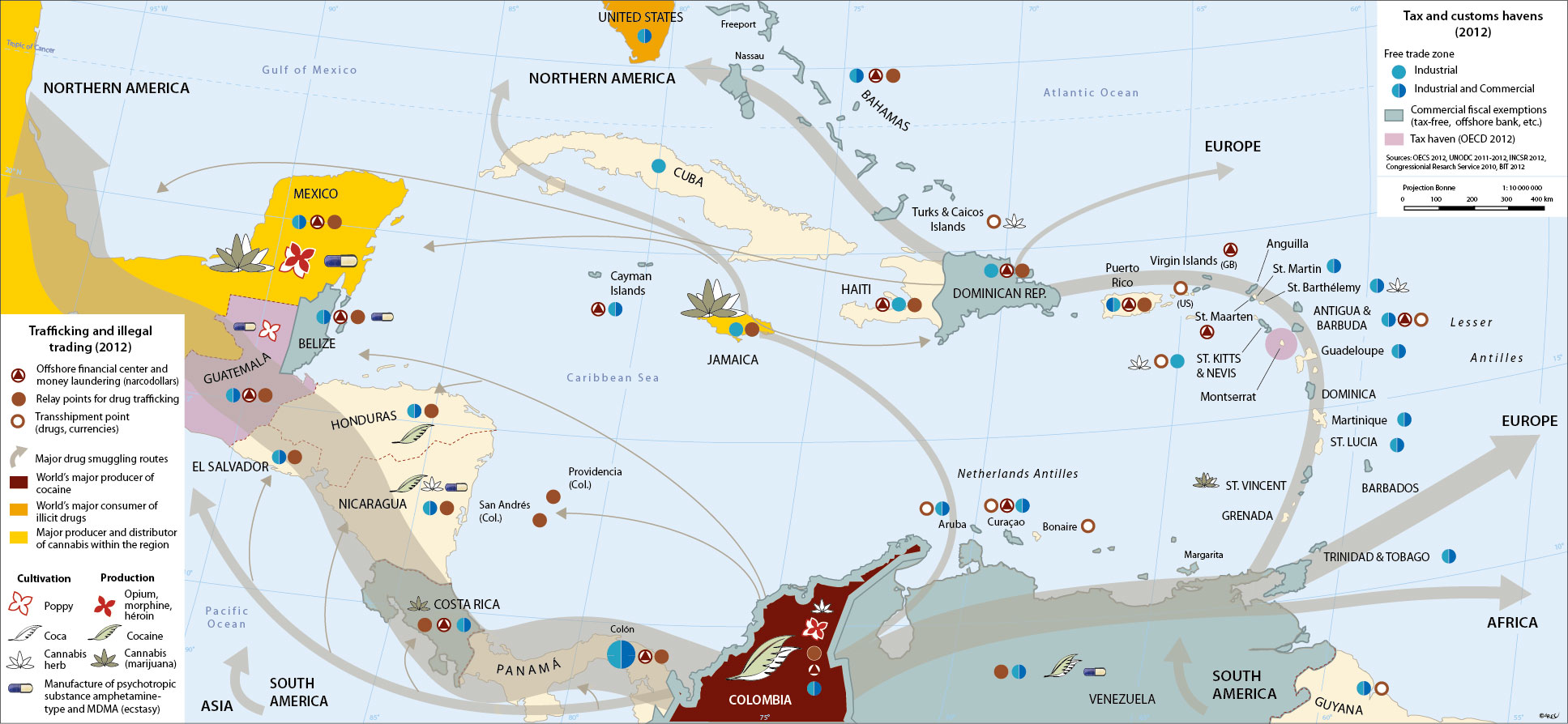

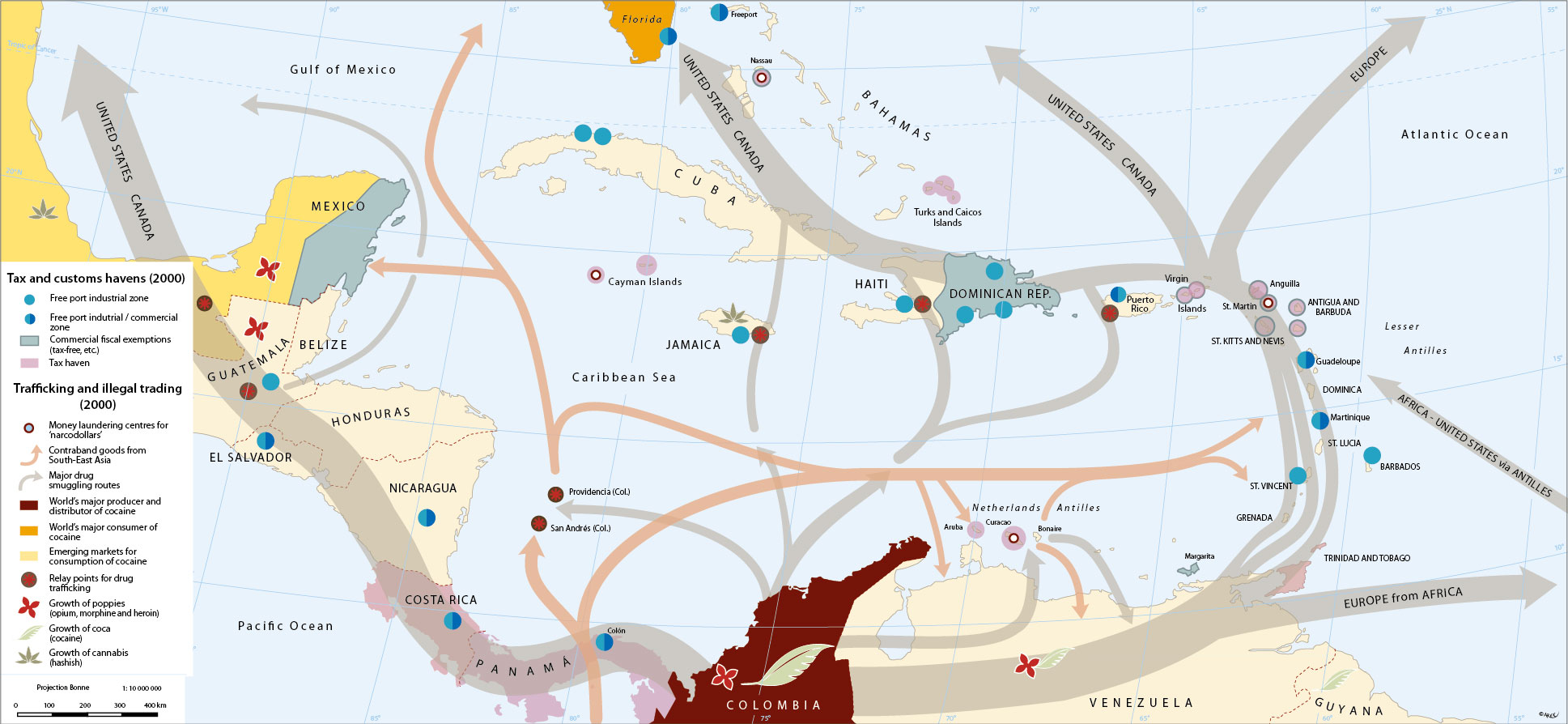

Insular Caribbean and its continental margins has emerged as one of several world regions liberally provided with designated zones offering a range of exemptions: 'free (port) zones,' duty free, 'fiscal havens,' financial 'offshore sanctuaries.' One should however distinguish between 'free zones' and 'fiscal haven:' the former have generally well-defined perimeters, albeit varying in area from a few warehouses (e.g. Port de Jarry in Guadeloupe) to several hundred hectares (e.g. Colón in Panama). By contrast, the latter extends to the whole of an island or state (e.g. the Turks and Caicos, the Bahamas). These two realities remain very distinct but are often confused with one another. Commercial practices relating to fiscal immunities and privileges of all kinds together with perfectly legal exemptions from common law, abound to such an extent in the Caribbean that even those territories not party to such derogations have their own separate dispensations. A simple customs or fiscal exemption may be replaced by a whole raft of preferential terms. Fraud and trafficking of all kinds also flourish behind their protective cloak. The dividing line is often very blurred between the legal and the illegal, the ultra-liberal and an excessive abuse of the system.

It is evident that the region as a whole embraces a remarkable convergence of favorableconditions. The massive influx of capital and goods generated by American finance and economic power underpins a number of preferential zones and exchange arrangements, exempt from local laws but operating in parallel with them. They maintain often complex, ambiguous and changing relations with the super-power neighbour: the criss-crossing of an Atlantic-Pacific axis by a North America – South America axis, the latter doubled by an intermediate isthmic-insular zone linking the two Americas, confers on the Caribbean the status of a strategically positioned, inter-regional 'turntable,' capable of providing an assembly and redistribution point for a miscellany of products (through Colón and Miami). However, it also facilitates the trafficking of drugs, arms, finance and contraband from south-east Asia. Simultaneously, many poorly resourced micro-states seek, in different ways, to exploit their geographical location. In this vast bidding process, reward comes to those who know best how to persuade and attract foreign investment. Both client and investor are kings, and play the game without inhibition in order to gain comparative advantage. Here an individual, there an industrial consortium, a shipping magnate, an offshore' company, the visitor discovers substantial opportunities … but so also does the narcotics trafficker or the gangland mafia, who with almost total impunity launder dirty money.

The Dominican Republichas very systematically multiplied the number of its free industrial zones. Exploiting their tax-free status, the Bahamas and Saint Martin have focused on tourism shopping. In the Caymans, Turks and Caicos, both capital and companies are attracted by lucrative banking and fiscal arrangements. The Cayman Islands have long been considered to be the most important fiscal paradise in the world, while Panama possesses the fourth largest merchant fleet, thanks to its lax "flag of convenience" legislation. Long tolerated for their facilities on offer, these fiscal havens today find themselves caught in the prism of international judicial proceedings, as well as nearby from the United States. Pressures are mounting demanding at least a minimum of transparency and cooperation.

top

|

|