- AEC et crise mondiale (2012) FR

- Abolitions of slavery

- Armées (2005) FR ES

- Armées (2015) FR ES

- Backyard of the United States

- Carribean Basin and global economic crisis (2008)

- Eric William's Pan-caribbeanism

- Essequibo : territoire "réclamé", territoire convoité FR

- Europe in the Caribbean (2007)

- Géopolitique de la Guyane FR ES

- Géopolitique de la Martinique et de la Guadeloupe FR ES

- Independence

- Les frontières FR ES

- Les processus de «réincorporation nationale» et de créolisation FR ES

- Mosaïque institutionnelle (2015) FR ES

- Mosquitia protectorado Inglés en colonias “independizadas” ES FR

- Political status (2012)

- Rapprochement Cuba - Etats-Unis FR

- Statuts et carte politique (années 1990) FR

- Tensions ethniques FR ES

The year 2008 marked the beginning of the new millennium. The triggering of a financial crisis, soon to translate into an economic downturn without precedent since the Second World War, would become worldwide in scale because of the globalisation of finance markets. Across the Caribbean, 2008 also proved to be a year of very violent and destructive cyclones. And finally, in the United States, a change of president saw for the first time the election of an Afro-American.

The Caribbean Basin (made up of the member states of the ACS, to which should be added Puerto Rico and the American Virgin Islands) constitutes the nearby geographical region most dependent on the epicentre of this economic crisis: the United States. The scope of this article surrounds the acknowledged immediate, but also probable longer term, consequences for the Caribbean Basin of this exceptional triple conjuncture of events. Given the recent onset of the economic crises, it would be presumptuous to evaluate its likely duration and intensity in real terms, which for the Caribbean augurs a heavy dose of uncertainty ahead. However, no member state can be excluded from its impact. Following a brief overview of this triple conjuncture, consideration is given to the differing consequences for this Central American region which embraces at the same time both large states (members of G3) and tiny islands (the Virgins, Cayman, Turks and Caicos…).

1. 2008: a truly exceptional year

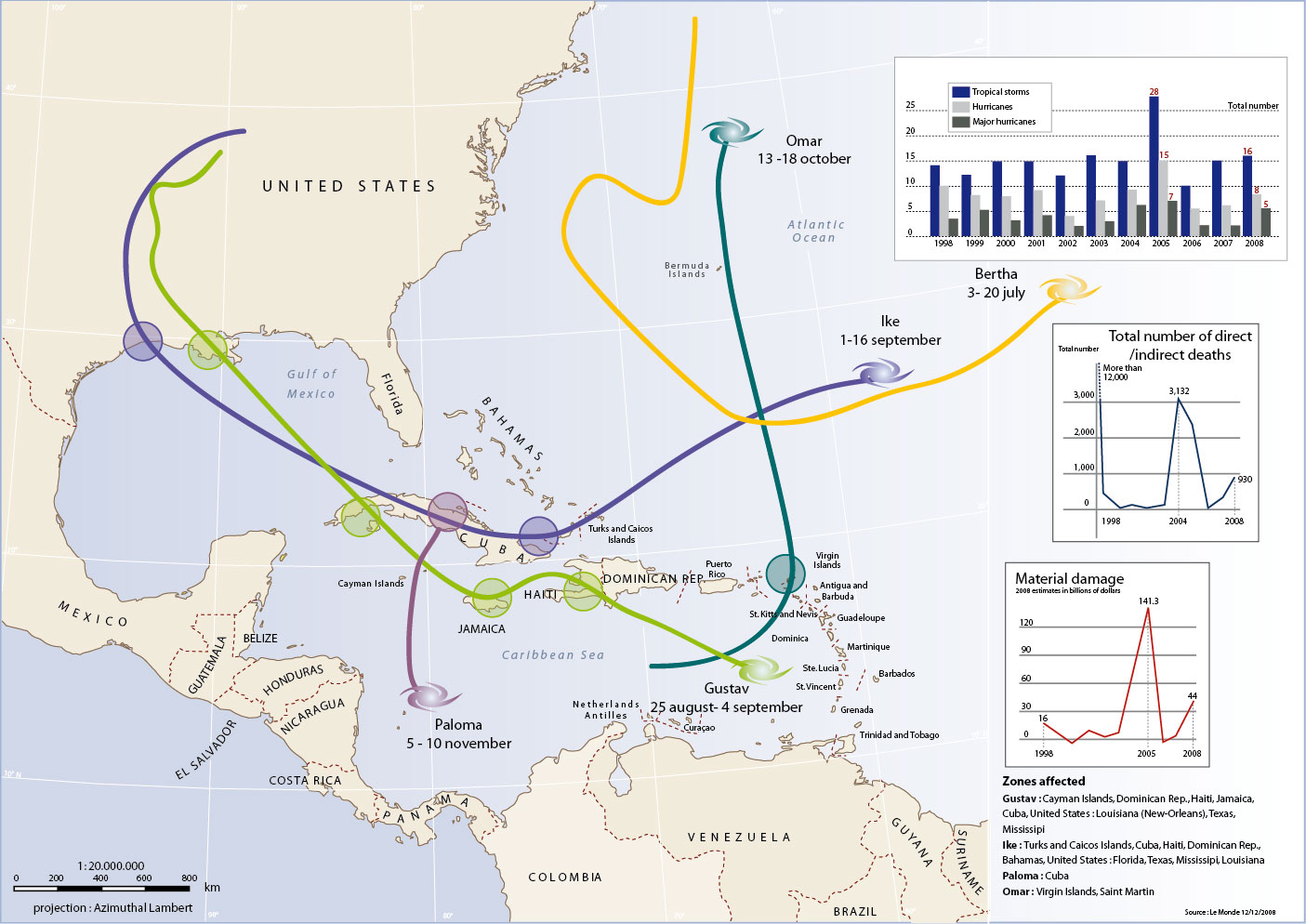

1.1. The violence and intensity of cyclones at the end of an exceptional decade

Figure 1 shows how 2008 brought about a very active culmination to a decade of intense cyclonic activity. The terrible year of 2005 alone witnessed more tropical storms and major hurricanes registering over 3 on the Saffir-Simpson scale, to which can be attributed nearly a 1 000 deaths and 44 billion dollars of damage (including the regions of Florida, Mississippi, Louisiana and Texas). Experts have yet to decide whether this is evidence of climate change or simply the return of a stronger natural cycle.

The difference this time relates to the regular seasonal distribution of the major cyclones: in 2008, the latter were spread between the months of June and November, whereas traditionally the season extends between 15 August and 15 October. Two of these strong cyclones followed an exceptional south-north trajectory: this was the case with Omar (13-18 October) and Paloma (5-10 November), originating in the Antillan sea. This pathway was at a complete tangent to those normally followed like Ike (1-16 September) and Gustav (25 August - 4 September).

Outside the coastal states bordering the Gulf of Mexico as far as the US, these cyclones affected all the islands, large or small, situated between latitude 15° N and the Tropic of Cancer. Small island archipelagos, prospering from tourism or from offshore financial activities, were badly hit, several islands lying only a couple of metres above sea-level. These included, from west to east, the Cayman, the Turks and Caicos, and the Virgin Islands (both British and US).

The Greater Antilles also paid a high price as a result of the violent climatic events. Cuba was hit successively by three major cyclones. Both urban infrastructure and agriculture suffered huge damage, such that the island did not refuse international aide.1 Haiti had to weather four cyclones, although it had still not recovered from the damage occasioned by those of the previous year.2 The Dominican Republic and Jamaica were also hit by the passage of several cyclones. The latter three states contain high levels of poverty, people living in slums, and the first victims of flooding, landslips and other destruction accompanying these powerful cyclonic events. In addition, the massive wave surges caused by the Omar hurricane ravaged the Caribbean coasts of the Antillan arc from Martinique to St. Barthelemy.

1.2. The surprise brought by the US presidential elections

For the first time in their history, the United States elected an Afro-American as their leader! It was viewed as an extraordinary event in the Caribbean, which represents the most racially mixed region of the American continent, legacy of Europe's old slave trade, and which marked its evolution for nearly four centuries.

In addition to this major landmark was the victory of the Democratic party itself; certainly the two-term Republican mandate of G.W. Bush was not noted for any priority being given to US-Caribbean relations. Yet this region remains the ‘backyard' of its giant northern neighbour, and the new administration is likely to differentiate its attitude from that of its predecessor. Within the US-ACS binomy, the central concern remains that of relations between the US and Venezuela and Cuba. The latter country also has a new head of state, Raul Castro who, it goes without saying, also awaits from Obama a change of policy direction in which the lifting of the embargo would mark a major new step forward. Raul Castro's first overseas visit was to Venezuela seeming to give prominence to the anti-American “Bolivarian” axis which Venezuela is bent on establishing. Within the ACS, the latter state can count on Cuba, and is seeking to align Nicaragua. The recent joint Russian-Venezuelan naval exercises hardly appear to be neutral act, nearly half a century after the Cuban missile crisis. However, should one not rather interpret these events in the wider global geo-strategic context where Russia and the US continue to defy each other by proxy in Georgia and Venezuela whilst awaiting future challenges, in the Arctic for example?

But 2008 heralded another exceptional event which passed unnoticed in Europe. This was the first Latino-American summit to take place with the support of the US since the independence of that continent! On the 16-17 November 2008 near Bahia, the Brazilian president convened a meeting of 32 Latin American and Caribbean states, each represented by their president or prime minister.3 This historic meeting ‘de facto' brought the Caribbean Basin (at least its independent member states) back within the Latin American orbit. In particular, the attendance of Raul Castro was noteworthy, symbolising the return of Cuba into the Latin-American family, forty-six years after its exclusion by the Organization of American States (OAS).

The new US presidency should thus pay attention to relations between its state and those of the rest of the continent, of which the ACS represents the nearest as well as remaining the most dependent on its powerful neighbour, at the same time as including within its sphere Cuba, the very state which most contests this quasi age-old situation. The serious economic crises presently affecting the US runs the risk of provoking protectionist policies towards which the Democrats have previously been more inclined than the Republicans. Keynesian policies aimed at re-launching rounds of public investment in the United States targeting job creation nationally have tended to favour the defence of American interests. Finally, the US can no longer ignore the disturbing growth of drug trafficking, particularly in Central America, as it has itself become the primary target destination of this narco-trade. Mexico appears to have replaced Colombia as the transit point in this sinister trade.4 The Mexican drug cartels are striving to ensure control of the regions through which cocaine destined for the US is transited between Colombia and Mexico. A terrible gang warfare currently ravages north and central Mexico, obliging state armed military intervention (36 000 soldiers).5 Neighbouring countries, in particular Guatemala, are contaminated by this violence.6

1.3. The most serious economic crisis since the Great Depression

The present crisis started with that of the international financial system in the second half of 2007. The banking system was shaken by the proliferation of “subprimes,” housing mortgages generously offered at variable rates by US banks to a clientele borrowing well beyond its means in respect of such loans. Toxic debts were spread by ‘slicing' and ‘bundling' across an international banking system enticed by large profit margins, before the opaque procedures and global ramifications of poorly assessed or concealed risks provoked bank failures and massif losses on the stock market.

2008 witnessed the impending crash of the largest American commercial banks, followed by those in Europe (UK, Ireland). Confidence underpinning the whole financial system disappeared, leading to a scarcity of credit because of both losses and its higher cost as well as mutual suspicion within the market. In a globalised economy hitherto based on abundant and cheap credit, the bottom falls out of the market, the wheels of the economy progressively seize up through the lack of liquidity. The scale of economic activity slows down and the onset of a recession becomes apparent in a capitalist system in which the most common regulatory mechanism remains the reduction of labour costs. Large-scale redundancies follow bankruptcies or market downturns in the face of consumer behaviour which, particularly in North America, had habitually depended on easy credit that had now become rare and costly.

It is still impossible to assess the full impact of the economic crises, as well as its likely duration, given that the turnaround in banking finances is far from over. Meanwhile, the recession has taken hold of the two economic engines driving the economies of the ACS member states: the US and the EU.

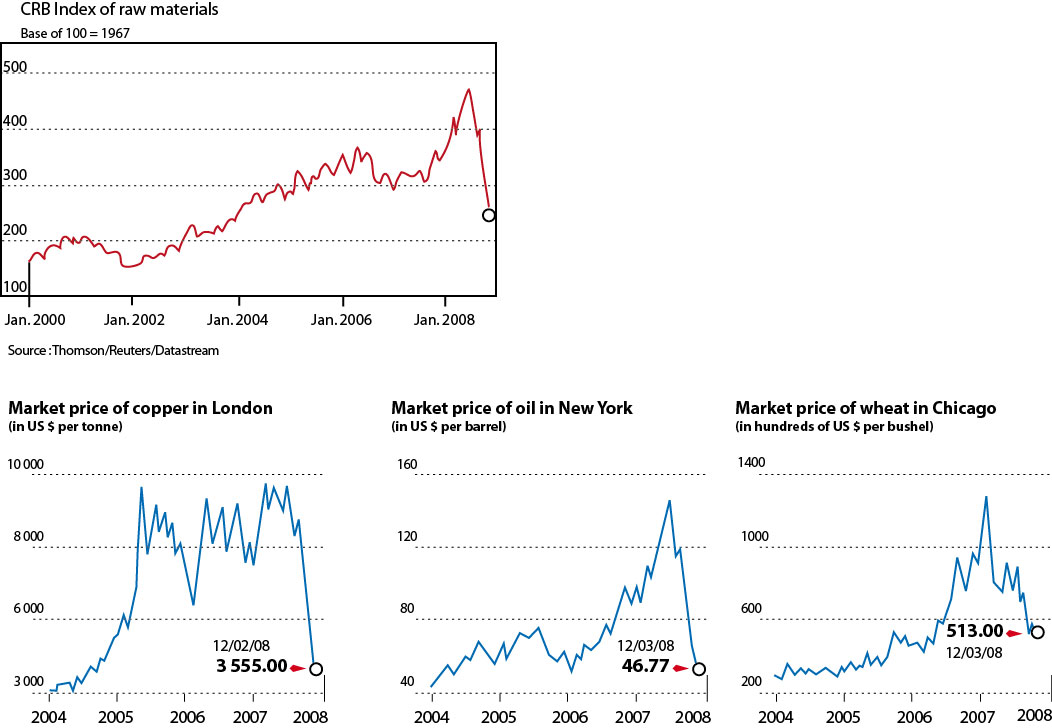

This same economic crisis has also led to great volatility in the price of agricultural and mineral raw materials, as shown in the graphs in figure 2.

In one year, the drop in prices has been severe: 67.6% for nickel, 60.5% for cotton, 55.5% for wheat, 41.2% for copper, and 29% for coffee. After peaking in July 2008 at nearly 150 dollars a barrel, the price of oil was stagnating at around 40 dollars by the end of the year. The very high price rise in raw materials resulted in part from the attraction that these exerted for essentially speculative investments which, in turn, strongly amplified existing trends in the real markets in raw materials. The financial crisis caused this speculation to fall back or disappear, and provoked a drop in prices. Even so, the latter provided evidence of a more or less anticipated strong fall in demand brought about by the economic downturn. Many investment projects are reconsidered as a result of the fall in share values of the companies dominating these sectors.

In the case of hydrocarbons the question was whether or not the short-term outlook of a world scarcity would provoke a similar rethink. All would depend on the duration and intensity of the economic crisis as well as the response of the producers, principally the members of OPEC in adjusting supply. The global appetite in energy needs of the developing countries remains a fundamental factor. Regardless of the present crisis and taking account of future and probable economic measures, such as the increased use of renewable sources of energy, oil should once again become expensive if only to avoid supplies running out too quickly. The present price no longer guarantees an economic return on projects involving extraction from non-conventional sources, and those oilfields still to be discovered below very deep waters or in the high latitudes, where exploitation will prove very costly.

2. The multiple consequences of the crisis for the ‘backyard' of its epicentre

For the ACS member states, the consequences of the economic crisis are both direct and multi-sectoral. Firstly, there is the very likely decline of Caribbean exports impacting as much on the agro-food sector as on manufactured goods originating from the freeport zones whether located across the archipelago or on the mainland.

The collapse of speculative investment funds will affect many Caribbean offshore havens and tourist resorts. Unemployment is soaring in the US.7 Above all, it affects the most vulnerable in society, mainly immigrants, of which the largest section comes from the Caribbean.8 The latter sometimes return to where they came from, but more often they stop sending the precious remittances (‘remesas') which provide the mainstay of so many Caribbean families.9 At the same time, the US like the EU is in the process of toughening up legislation relating to illegal immigrants (more than 12 million are in the US). Tourism is fundamental to the economies of most of the West Indies, particularly the smallest states. Of course, the Caribbean Basin remains a nearby and relatively cheap destination, which some North American holidaymakers may prefer to more expensive choices further afield (Europe, Asia). By the same taken, for a European clientele staying nearer to home could be to the detriment of the West Indies, and to the benefit of less expensive places (Mediterranean coasts). The fall in living standards of middle-class Americans would normally impact on their holiday budgets. For now, the Caribbean still remains the premier destination for this client base, both for staying on holiday and cruises.

The economic crises also runs the risk of increasing poverty in the Caribbean Basin and of setting back the social progress achieved to date of societies where inequality remains strongly entrenched. It also risks exacerbating a general sense of insecurity nourished by such socio-economic inequalities and the hydra of drug trafficking.

2.1. Paying a heavy price across the Antilles

The awesome hurricanes of 2008 scarred the northern half of the Antilles from the Cayman to the Virgin Islands. The local infrastructural damage worsened the impact of restrictions on North American outlets for their produce (Jamaica, Dominican Republic). Cuba, totally battered by the bad storms, was the least affected by the economic conjuncture, as the state the least integrated into the globalised economic and financial system. Haiti appears the most vulnerable, the most disorganised, and the poorest. She emerges from 2008 drained of her very lifeblood, without hope of any solution in the short-term to counter its institutional weakness.

Because of their status, Puerto Rico and the Virgin Islands would logically follow a trajectory similar to that of Washington but with a social complexion inevitably worsened by comparison with the continental mainland. The three French metropolitan overseas departments (‘Overseas Regions') should also stand out, their status implying an economic conjuncture traced from that of France. The high proportion of public sector employment (departments of State, hospitals, local authorities) should in part dampen the impact of the recession. But the cost of travel across the Atlantic may well restrict tourism and visitor numbers in the French Antilles.

Trinidad appears as a place apart in the West Indies. Regional producer of hydrocarbons, the country has amassed petrodollars, but the recent and brutal drop in oil prices could threaten its investment projects.10 Wisely, the island has oriented itself towards the export of liquefied natural gas, a more stable market than oil. If the projected gas pipeline supplying the Antillan arc as far as Puerto Rico is realised, the island will reinforce its pre-eminence in energy production across the Lesser Antilles, including many of CARICOM's member states.

Offshore havens are numerous across the West Indies: beyond just the destructive impact of recent cyclones (Cayman, Turks & Caicos, Bahamas, British Virgin Islands) their financial role could well suffer further for various reasons. The first relates to these grey areas of international finance remaining useful, indeed indispensable, within the latter system in mounting complex projects, as against the never-ending temptation of holders of capital to minimise, even evade, payment of tax. The second stems from these havens constituting ideal places for ‘laundering' money flows relating to criminal activities. These are multiple (drugs, arms, migrants, gambling, prostitution, contraband) and generate considerable sums of cash, necessitating that the funds so acquired be legalised (‘laundered'). Right in the middle of a financial crisis when there is a brutal lack of liquidity, will these fiscal havens, shaken by general suspicion regarding their opaque practices, be tempted to absorb discretely this welcome manna to give new life to flows of investment? It becomes all the more likely that plans to reinforce means of regulation, the constant refrain after each economic crisis, will hardly prevent these same offshore havens from once again proving of use when the downturn is reversed.

2.2. Central America's concern for its exports and emigrants

Panama apart, the states of Central America are large-scale exporters of agro-food products (bananas, coffee, cotton) that have suffered fluctuating prices on the world markets, whilst their own domestic food production remains insufficient, or faces competition (maize) with the production for bio-fuels.

The most worrying ramification of the economic crisis concerns migration flows stemming from these countries. Expatriates send back home remittances vital for the economies of these states, already plagued by socio-economic instability (with the exception of Costa Rica) with huge differences in wealth and growing insecurity stirred up by drug trafficking and gang violence (‘maras') found in most large cities.

Panama in the isthmus remains apart. It is the most “tertiairised” economy, the most “dollarized” and most “globalised.” Its financial position is unsettled by the crisis, at least as regards its legal activities. Even if canal traffic does not suffer like that of Suez, as a consequence of maritime piracy, it will be affected by the downturn in world maritime trade consequent on the recession. Boasting the world's largest merchant fleet under a ‘flag of convenience' Panama will experience the present brutal collapse in freight rates with the effect of immobilising a growing number of bulk carriers deemed to be uneconomic.11 Panama must also plan earlier than anticipated for future competition from the Northwest Passage, which will cut 5 000 km off the current route between Tokyo and London, and 7 000 km between Asia and the Atlantic coast of the United States.12

2.3. Mexico appears the most affected of the G3 states

The member states of the G3 are important producers and exporters of energy: hydrocarbons to which should be added coal in the case of Colombia. Having benefitted from high prices over the last two years, these same countries are now suffering from a drop in the price of oil. Colombia is closest politically to the US and its economy is more diversified than those of the other two members. All the same, this country is far from having resolved its problems of internal security and socio-economic stability.

As a member of NAFTA, Mexico is the most globally integrated of the 3, and as such is experiencing the full force of the effects of the economic situation in the US. Note, for example, the cutbacks as in the outlets for numerous “maquiladoras,” and in particular in the automotive sector. The United States has recently prioritised the production of bio-ethanol, which has restricted their sale of maize to Mexico, where the population has seen a high rise in its basic food prices (tortillas). It is in this same country that the US economic downturn has had the most serious consequences for emigrants. The latter, either illegally resident or long settled in the neighbouring state to the north, are now badly hit by unemployment. Their remittances totalled 24 billion dollars in 2007, in other words the second largest source of national revenue after hydrocarbons and ahead of tourism.13 The question now is whether the latter will also be affected. Mexico is also suffering from the fall in the price of oil, in addition to the national structural weaknesses besetting this sector. With its oil sector (exploration, production, transport) contractually completely closed to outside capital investment, Mexico uses its national company PEMEX as the conduit for public finance. With overall production declining because of the exhaustion of its major oil fields, PEMEX does not possess the technological expertise of, say, PETROBRAS necessary to exploit deep-water sources. Combined with an increasing national consumption in a country not particularly economical in energy usage, the margin available for export is becoming limited, obliging Mexico to reflect in the medium term on a future life “post-oil.” These economic difficulties must be read in the context of a difficult and contested presidency, as well as a climate of growing insecurity which, having started in the border states, is now spreading across the whole country.

Venezuela is the largest exporter of oil in the American continent, which has allowed it to accumulate currency reserves in support of a dual regional and international geopolitical strategy. The first relates to its nearby Caribbean neighbours whom it supports with cheap oil14 (Cuba, Central America, Haiti, Jamaica, and Dominican Republic with the accord of Petro-Caribbean). In South America, Venezuela aligns itself with Bolivia and Ecuador, and has just become a member of MERCOSUR. But this “Bolivian” axis has not attracted the other left-leaning states, like Chile or Brazil, the latter believing itself to be the natural leader of Latin America. At the international scale, “Chavismo” has led to links with Iran, India, and above all China, with its eye on Venezuela's underground natural resources. These new partners could in the longer term relieve Venezuela's heavy dependence with regard to the announced official enemy: the USA.15 Venezuela remains a ‘petro-economy:' hydrocarbons make up half the country's receipts and 90% of national exports by value. These petrodollars underpin the essential base of a national policy of social subsidies. The present collapse in oil prices represents a major handicap to the policies of President Chavez, who has recently suffered a partial setback at the regional elections. More and more, the country's oil resource, heavy and viscose, requires costly refining processing, the PDVSA having previously neglected to make the necessary investments in a highly capitalist sector. In a similar vein, recent strategic initiatives with Russia appear to stem from postures of prestige which, in the new global economic context, run the risk of exceeding the actual capacities of their initiator.

On the southern doorstep of the United States, from where the present crisis originates, the Caribbean Basin can only suffer from the consequences. All parts are not equally affected. The small archipelagos of the northern Antilles without doubt suffered more from the cyclones of 2008 than from the lashing received as a result of the stock market speculation losses. For the large islands, the damage resulting from aberrant weather conditions would be added to restrictions placed on North American trading outlets. The latter was more in evidence in Central America and Mexico, countries which in turn would see the weakening of their safety valve represented by the previously constant flow of emigrants and the remittances sent back from across the border of their American neighbour to the north.

The complete structural turnaround that now characterises the Caribbean economies leaves one to conclude that the solutions required to extricate these countries from the present crisis will, like the causes, come in large part from outside the region.

1 Cuba had requested from the US a temporary lifting of the trade embargo so as to purchase construction materials and foodstuffs. This was refused by Washington who required their offer of aid of $100 000 to be linked to an on-site survey of damage, a demand refused by Cuba.

2 The central region of Haiti suffered a veritable disaster with several dozen deaths. For example, the town of Gonaïves, fourth largest in the country with 260 000 inhabitants, was at the end of October invaded by 2.5 million cubic metres of mud and detritus! The situation was made all the worse by the country's broken-down socio-political situation, with no real security or public order.

3 Out of the 33 member states present, 25 were from the ACS, with Peru and Colombia being absent, both countries politically close to the US who will be presiding the annual summit of the Americas in 2009 in Trinidad.

4 The UN Anti-Drugs & Crime Agency (UNADCA) estimates at $300 billion the total cost in terms of public health and security borne by the countries that are the victims of violence linked to drug trafficking in Latin America and the Caribbean (i.e. 16% of regional GDP).

5 In October 2008, deaths from this gang warfare totalled 3 200 (see Le Monde, 11/10/2008).

6 The public authorities in Guatemala acknowledge that they no longer control the north of the country (Flores), where there were 6 200 homicides in 2008, 518 more than in 2007, in a country that has seen one civil war (1960-1996) which saw 200 000 deaths.

7 In December 2008, the US economy lost 526 000 jobs, the highest recorded figure since 1945!

8 Since the ‘subprime' crisis (mid-2007) in the US, the construction sector has seen 250 000 ‘latinos' made redundant.

9 In 2006, emigrant remittances as a percentage of Gross Domestic Product represented: Honduras, 26%; Guyana, 24%; Haiti, 22 %; Jamaica, 18%; El Salvador, 18%. Furthermore, every year more than 50% of qualified students of the ACS member states emigrate (source: World Atlas of Migration).

10 Such as the island's rapid north-south link.

11 The calculation of the Baltic Dry Index is based on prices applicable on 24 maritime routes for the transport of dry bulk (mineral ores, metals, grain). From 1998 to 2005, the price oscillated between 900 and 1 100 points, then leapt to more than 4 000 from 2005 to 2007. 2008 saw a peak of 11 793 reached on 20 May, then a fall to 818 points by 19 December, i.e. nearly 15 times less.

12 The first commercial use of the Northwest passage by a ship belonging to a Canadian company took place in September 2008. The navigable waterway with very little floating ice allowed the ship to sail from Baffin Bay in the East, via Cambridge Bay, through the Gulf of Amundsen which opens into the Beaufort Sea to the West, then returning to the port of Nanisivik in the East.

13 In the sole state of Michoacan, 2.5 million nationals are now settled in the US. Their remittances in 2007 rose to 2.25 billion dollars that is the equivalent of the total federal subsidies received by this state (see Le Monde, 28/11/2008). The Economic Commission for Latin America (ECLA) has predicted the return of 2 to 3 million Mexican nationals in the coming months.

14 The PDVSA has a subsidiary in the US, the CITGO, which in 2005, following the onslaught of Katrina, decided to supply cheap fuel to affected American families in need. In 2008, 200 000 families benefitted at a cost of 100 million dollars. Threatened by the recent drop in oil prices, the programme has nevertheless been continued by Chavez, mindful of giving the Bush administration a lesson (see Le Monde, 09/01/2009).

15 Venezuela exports annually around 50 million tonnes of crude oil and refined products to the US, representing half its exports of hydrocarbons, whereas these tonnages only amount to 10% of American imports (as against 17% in 1996).

top

|

|